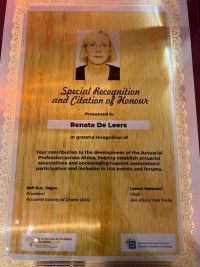

Renata De Leers received a Special Recognition and Citation of Honour of the International Actuarial Association (IAA) at the 6th African Actuarial Congress in Accra.

Special Recognition and Citation of Honour

At the 6th African Actuarial Congress (June 2022) in Accra, Renata De Leers received a Special Recognition and Citation of Honour of the International Actuarial Association (IAA) because of her contribution to the development of the Actuarial Profession across Africa, helping establish actuarial associations and encouraging nascent associations' participation and inclusion in IAA events and forums.

At the 6th African Actuarial Congress (June 2022) in Accra, Renata De Leers received a Special Recognition and Citation of Honour of the International Actuarial Association (IAA) because of her contribution to the development of the Actuarial Profession across Africa, helping establish actuarial associations and encouraging nascent associations' participation and inclusion in IAA events and forums.

We asked Renata for a reaction:

"Let me start from the beginning which explains my involvement in Africa.

When I was a child I wanted to become a development worker in Democratic Republic of Congo, teaching children or working in a hospital. But my parents told me to study first a decent degree to make my living. So I became an actuary and worked eight years in Belgium. Then I decided to follow my dreams, combine travelling with my profession and contribute to human and social development in developing countries (the actuarial ‘Tintin’). I was not driven by making money but sharing what I knew and what I had but by a passion to travel and interact with people from different cultures, in different lanaguage and in many countries.

So I worked from the nineties first in the Middle East than in Africa, which was not easy. It means calculating a number for the reserves provided by the CEO, pricing products as oriented by the commercial manager. In Social security, you need to consider also politics. And when you are a CEO, the shareholders may not appreciate that you pay claims. This is still our day-to-day in many African countries and nobody dares to speak about those realities or just whistle.

In such an environment, I learned to ‘un-learn’ what I was used to do (and what you do today ) in mature markets ruled by Solvency2 and IFRS17. This is what is necessary to promote and develop the insurance and the actuarial profession in developing (mainly poor income)and emerging (mainly low middle income) countries. You cannot copy and paste what is good in a country with GDP/capita of 40 000 USD in a country with GDP/capita of 1000 USD. Disposable income is different and in developing countries people care about today and not the far future.

I can write a book about the last 30 years but let me share a fantastic experience with NIC (National Insurance Commission) in 2010 and 2011 in Ghana. I had a team of 5 young professionals at NIC and they all became successful actuarial entrepreneurs. Also the Actuarial Society of Ghana changed a lot during the last decade. You won’t be believe how proud I am !

When I worked at NIC, young actuarial undergraduates selling MTN cards came to see me to ask for work. Nearly 800 undergraduates and only few worked in the insurance industry. This was the trigger for a mandatory actuarial unit in each insurance company. You can imagine that not everyone liked this idea…

Also it was the beginning of microinsurance in Ghana. Not known, so not loved. I even got emails telling me to return to France where products are simple and unit priced. Well, I never worked in France and I am not French…very icy experience but it tells you how difficult it was in the beginning of microinsurance and mobile insurance. Today after 12 years, Ghana became a model for microinsurance and mobile insurance…Who would have thought that in 2010 ?

I will finish now in recalling that actuaries not only serve shareholders and clients, but should consider seriously serving public interest and become social conscious.

In Africa this means contributing to human, social and financial development, realizing the SDGs, the ESG principles. Especially contributing to ‘S’ in ESG principles: decreasing income inequality which will increase the economic growth and the insurance penetration rate (or is it the opposite ?).

Diversity and inclusion are amongst the core values of the IAA. In Africa respect for diversity should be emphasized. Indeed, Africa is a continent with 54 countries, with many cultures, with many languages.

Working effectively with actuaries from all educational backgrounds, and showing respect for and understanding of the diverse points of views, not discriminating against any individuals or groups, are necessary to succeed in the development of a panafrican actuarial profession.

To emphasize the diversity in Africa, Rokhaya Kandji from Senegal and Francis Gota from Ghana received the award on my behalf. Rokhaya is French speaking and Francis English speaking…. I hope their generation will be able to bridge the gap between those two Africa’s for the sake of having one actuarial profession in Africa.

Despite my personal challenges, I hope to continue, by the grace of God, contributing to the wellbeing of people through Actuaires du Monde which continues the work of Actuaries without Borders, emphasing social and financial development in developing and emerging countries."

We join IAA in thanking and congratulating Renata for her endless commitment to the actuarial cause. IA|BE is delighted to have such a dedication among its members!